What is an Online (Robo) Financial Advisor?

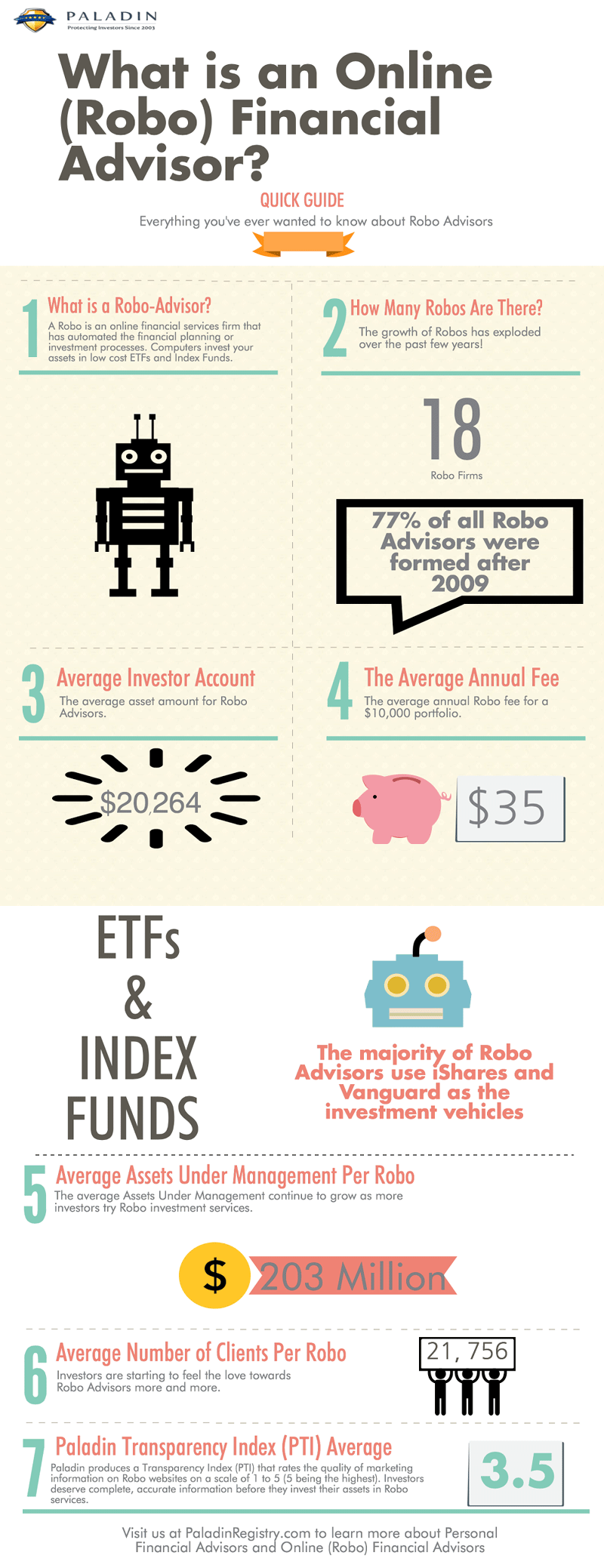

Lately, there has been plenty of talk on the emergence of “robo-investing”, or automated online investing.

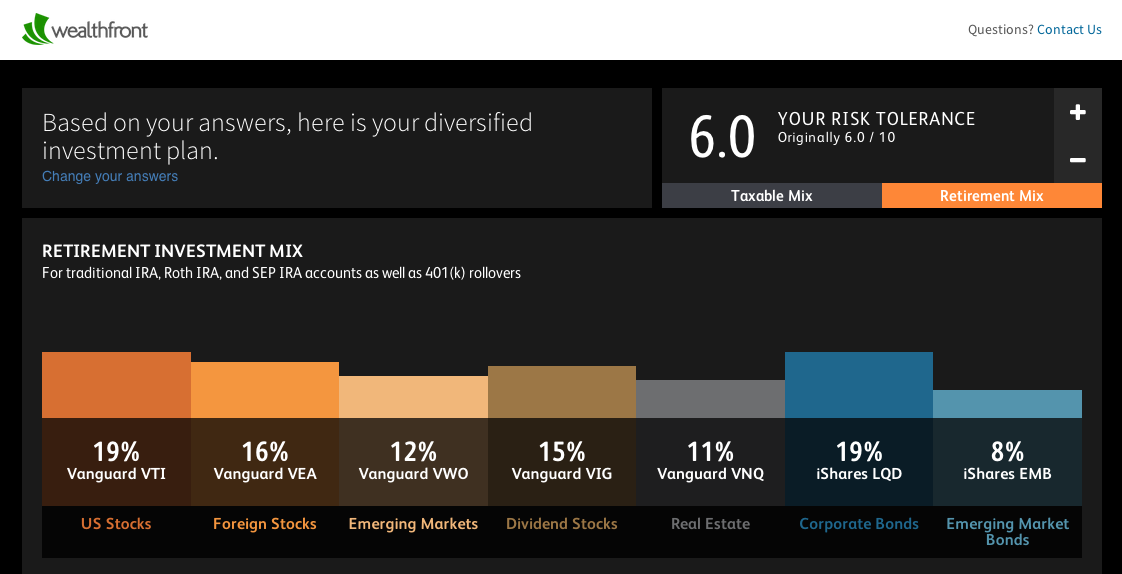

The website will take an investor’s preferences, time horizon, risk tolerance, and other information into account, and create a wealth management plan using its algorithms. It works 24/7 to manage a client’s money, and makes adjustments on the fly based on what is happening with the account and the market.

Firms specializing in these services have popped up frequently since the Financial Crisis. Wealthfront is one of the largest in the United States, currently managing over $2 billion of assets as of today. They have been slower to emerge in Canada, but Wealthbar and Wealthsimple are two that have recently launched.

Here’s a screenshot of Wealthfront’s portfolio allocation suggestion based on one users’ retirement and risk preferences.

You’ll notice there are plenty of Vanguard and iShares ETFs, and this is a common feature among online wealth management tools. To keep costs down they will almost always use such low-cost pooled funds. Also, they must play along with securities regulations and the “Know Your Client” concept and keep from out-stepping any grey areas. This is a benefit for a very conservative investor, but for anyone who wants to invest in blue chip stocks, growing companies, or speculative opportunities, obviously it won’t be the right cup of tea.

Original graphic from: Paladin Registry