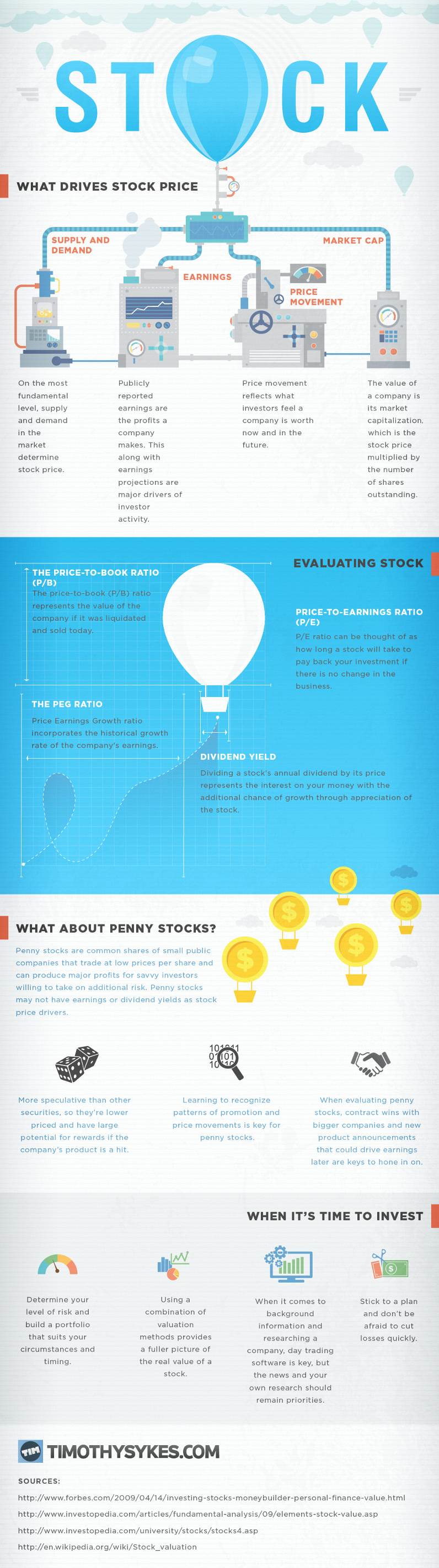

What Drives Stock Price?

This is a basic yet fundamental question: what drives stock prices?

In the most literal and superficial analysis reveals it to be simply supply and demand. If more people want a stock than are selling, the price increases. This is technically the most true answer, but obviously if the underlying value of a security is no longer worth the price it is selling for, then investors and traders will be likely ditch a stock.

That is why there are different ratios and metrics that help us figure that out, which are outlined in the above infographic. The most basic metrics are earnings, price movement, and market capitalization and are straight forward.

The next level of complexity is using ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B), Price Earnings Growth (PEG), or dividend yields. These numbers are much more concerned with value, and allow more direct comparisons between different equities. As an example, a P/E ratio can tell an investor how long it will take to hold a stock for it to pay back its investment based on the company’s current earnings.

There are also fundamentals around smallcap and microcap stocks worth noting. Chiefly, that there is plenty of volatility and that they tend to follow similar patterns because of their lower liquidity and speculative nature.

Original graphic from: Timothy Sykes