Family-Owned Businesses, by Share of GDP

In many ways, the engine of global economic growth is hidden in plain sight.

Family-owned businesses, which make up 90% of global enterprises, have driven job creation and entrepreneurship over history. While the majority of these are mom-and-pop shops, some of the world’s largest companies, from Walmart to Ford, are family-run.

This graphic shows the economic influence of family businesses in select countries, with analysis from Tharawat.

Family Businesses and the World Economy

Below, we show the economic contribution of family businesses around the world:

| Country | Family Business Share of GDP |

GDP 2023 | Estimated Contribution to GDP |

|---|---|---|---|

| 🇮🇳 India | 79% | $3,737B | $2,952B |

| 🇪🇸 Spain | 70% | $1,492B | $1,044B |

| 🇲🇽 Mexico | 70% | $1,663B | $1,164B |

| 🇮🇹 Italy | 68% | $2,170B | $1,476B |

| 🇬🇧 UK | 67% | $3,159B | $2,117B |

| 🇵🇹 Portugal | 67% | $268B | $180B |

| 🇨🇦 Canada | 60% | $2,090B | $1,254B |

| 🇺🇸 U.S. | 54% | $26,855B | $14,502B |

| 🇨🇳 China | 51% | $19,374B | $9,881B |

| 🇩🇪 Germany | 49% | $4,309B | $2,111B |

| 🇪🇨 Ecuador | 40% | $121B | $48B |

| 🇦🇪 UAE | 40% | $499B | $200B |

| 🇳🇱 Netherlands | 25% | $1,081B | $270B |

| 🇮🇩 Indonesia | 10% | $1,392B | $139B |

As the above table shows, 79% of India’s economic output is fueled by family-owned businesses, the highest across the dataset.

Reliance Industries is the largest family enterprise in the country, and the 10th-largest globally. Founded in 1973, it is run by the Ambani family and has a $204 billion market capitalization as of December 2023.

Following India are Spain and Mexico, with family businesses making up 70% of GDP and contributing over $1 trillion to these economies each year.

In the U.S., an estimated 32.4 million businesses are family-owned that collectively generate $14.5 trillion in GDP. The largest of these enterprises are Walmart, Berkshire Hathaway, and Cargill.

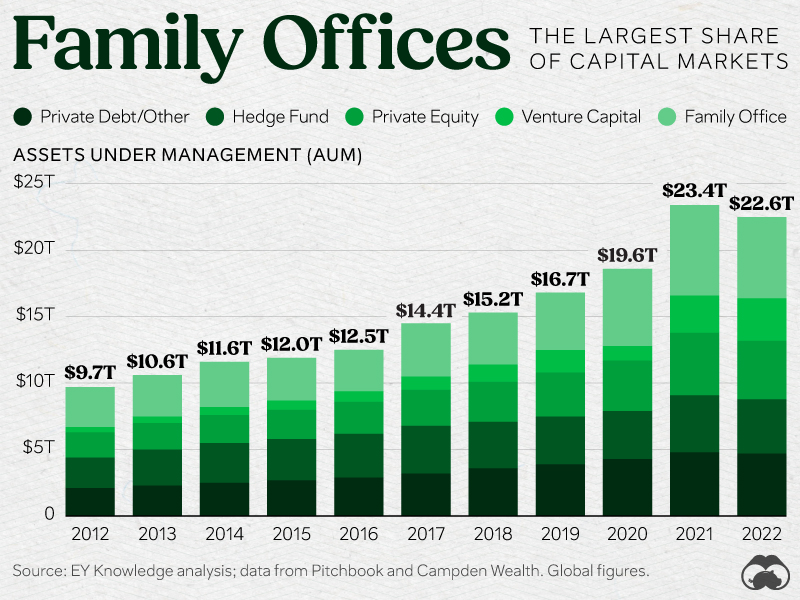

Family Offices in Private Capital Markets

Just as family businesses have significant influence over global GDP, family offices also own a large portion of global assets.

In fact, they make 27% of private capital markets globally, with $6.1 trillion in assets under management—more than doubling over the last decade.

While the majority of family office assets are invested in funds, there is a growing trend of investing directly in target companies, such as tech start-ups.

By 2027, Ernst & Young projects that private markets will expand considerably, facing a similar trend seen over the last decade—with family offices playing a key role in driving this growth.