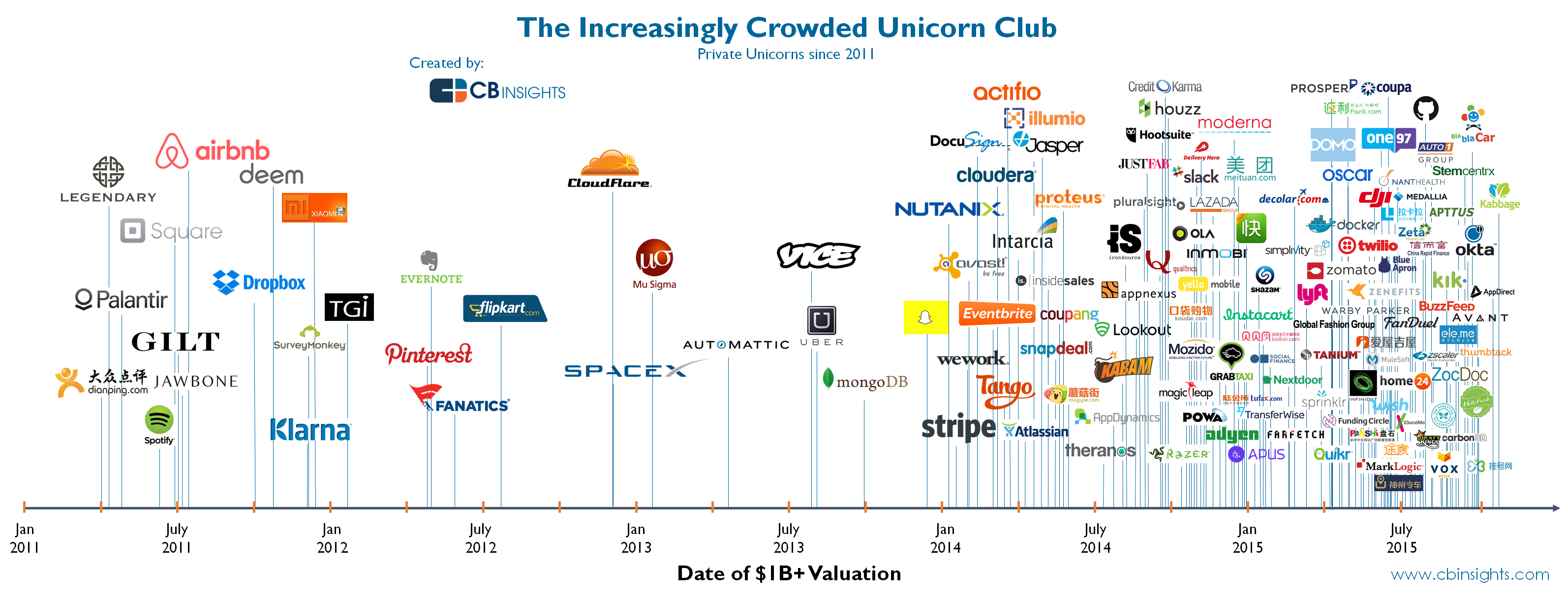

The Increasingly Crowded Unicorn Club

Unicorns, a moniker applied to private startups valued at over $1 billion or more, are supposed to be mythical in nature.

At best, there are supposed to be so few of them that venture capital firms would be absolutely elated to have a stake in any unicorn out there. (Or even their Canadian narwhal equivalents)

However, the truth is that unicorns are simply not rare or mythical anymore. According to the real-time list that CB Insights hosts, the number is now at 145 unicorns globally. In other words, the once exclusive Unicorn Club is becoming increasingly crowded.

That said, the odd member of the club does find the door.

Square, a prominent member of the club led by Twitter co-founder Jack Dorsey since mid-2011, finally IPO’d just a month ago with mixed results. It rose money from the public market at $9/share, which was a significant discount on the last private capital it raised at $15.46/share. Today it is trading closer to $12, which shows there is still optimism towards these kinds of technology companies.

Box’s IPO in January 2015 also sent mixed messages. It was privately valued at $2.4 billion, but then IPO’d at $1.7 billion. It soared on the first days of trading to $2.7 billion but then fell back down to a value below its IPO as lockups on insider traders expired during the summer.

Is the appetite for unicorns still frothy, or is it starting to sour?

We certainly agree that many of these companies have a great opportunity ahead of them. Many are growing at breakneck speed, and others are starting to find ways to monetize their offerings. However, is there really room for hundreds of them?

Today, the Australian software company Atlassian IPOs on the Nasdaq with a reported valuation of $4.4 billion. At time of publishing, it is up 33% on the day, and we will be continuing to watch the stock closely.