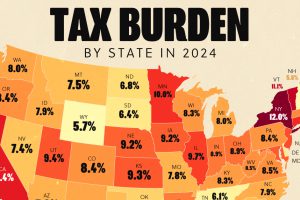

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic. Read more

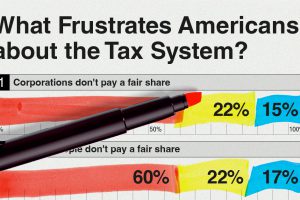

A survey during peak tax filing season reveals two big complaints that Americans have with the federal tax system. Read more

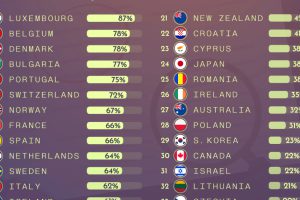

Ranking countries and their unemployment benefits, measured by the percentage of previous employed income received after a year out of work. Read more

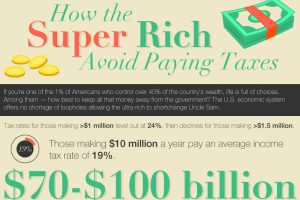

10 Ways the Rich Avoid the Taxman Nobody likes taxes. However, when the super rich are stuck in forfeiting millions of dollars to taxes each year, they probably despise them… Read more

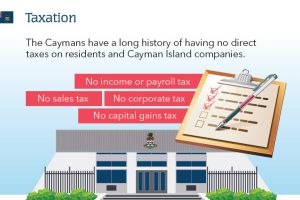

The Cayman Islands have a rich history of indirect taxes and have now introduced a new Special Economic Zone, making it one of the best places to do business in… Read more

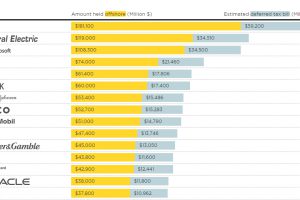

Big companies store billions of dollars in offshore tax havens. Here’s the 30 companies in the Fortune 500 that have the most money offshore. Read more

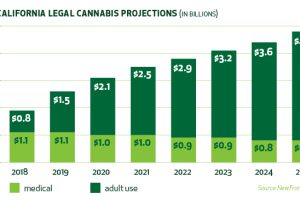

With 39 million people and the world’s 5th largest economy, the California cannabis market has immense potential – that is, if companies can navigate it. Read more

The worst states to retire in are those that are expensive and cold. But there’s a surprising warm weather entry as well. Read more

The best U.S. states to retire in are those that are affordable and warm. But #1 is from the mid-Atlantic region. Read more