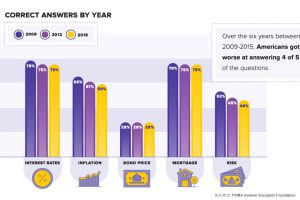

Financial literacy has been dropping for years in the United States – and with student debt at all-time highs, how do we put our students in a spot to succeed? Read more

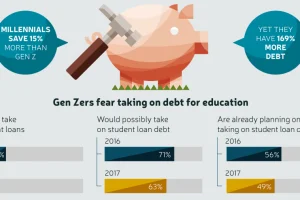

Gen Z saw their older friends take on massive amounts of debt, while struggling to secure stable jobs – and now they are learning from those mistakes. Read more

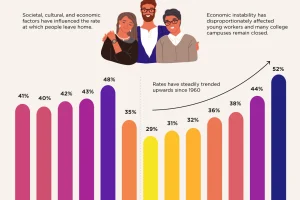

Today 52% of young adults aged 18-29 live with their parents. Economic and societal factors have played a part in addition to the COVID-19. Read more

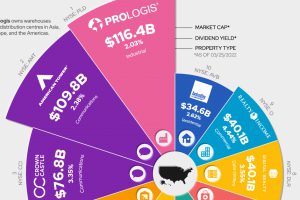

Real estate investment trusts (REITS) are a simple alternative for investors looking to gain exposure to real estate. Read more

Only 22.7% of U.S. students are required to take a personal finance course. Which states have the highest levels of personal finance education? Read more

After a borrowing spree during COVID-19, younger Americans are struggling to keep up with their auto loan payments. Read more

Getting ready for retirement? See which states score the highest in terms of affordability, quality of life, and health care. Read more

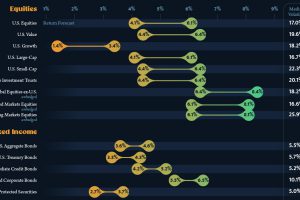

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard. Read more

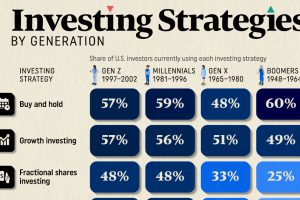

Buy and hold remains the most popular investing strategy across generations, with Baby Boomers relying on this strategy the most. Read more