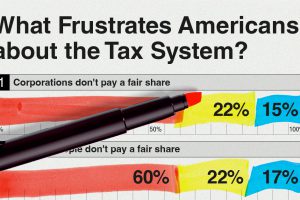

A survey during peak tax filing season reveals two big complaints that Americans have with the federal tax system. Read more

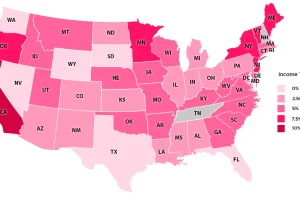

How green is the grass on the other side of the state border? See the U.S. states with the lowest income taxes in this series of maps and charts. Read more

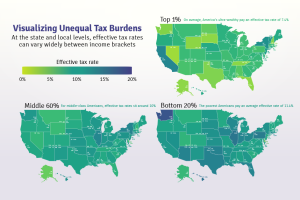

Poor families pay a higher share of their income towards state and local taxes than wealthy families. These maps show the inequitable tax burdens. Read more

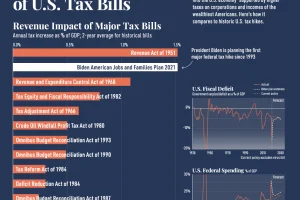

President Biden is set to inject trillions into the economy through higher taxes. Here’s how the tax hikes compares to historic U.S. tax increases. Read more

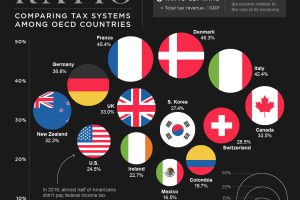

Using the tax-to-GDP ratio, we compare the tax systems of 35 OECD countries. See which nations have the highest and lowest rates. Read more

An annual income anywhere between $360,000-$950,000 can grant entry into the top 1%—depending on where you live in America. Read more