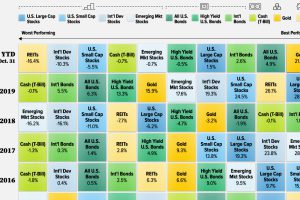

Chart showing historical returns by asset class from 2004-2014. How do investments in bonds, equities, real estate, gold, and commodities compare over time? Read more

What are the best-performing investments in 2020, and how do previous years compare? This graphic shows historical returns by asset class. Read more

Around the world, 20 stock exchanges have a market cap above $1 trillion. Learn how international equity investing opens new possibilities. Read more

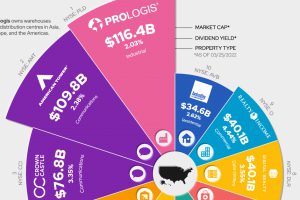

Real estate investment trusts (REITS) are a simple alternative for investors looking to gain exposure to real estate. Read more

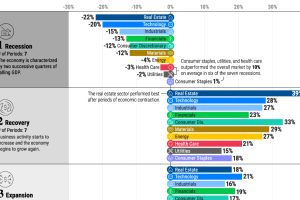

We show the best performing S&P 500 sectors over each phase of the business cycle using nearly seven decades of data. Read more

Where are some of the riskiest countries to invest in the world? Where are some of the safest? This graphic shows country risk in 2023. Read more

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees. Read more