Structured Notes: The Secret to Improving Your Risk/Return Profile?

Structured notes are gaining momentum in the market, with a whopping $2 trillion in assets under management (AUM) globally.

So why haven’t more investors heard of them?

Traditionally, structured notes had a $1 million minimum investment. They were only available to high-net-worth or institutional investors—but they are now becoming more accessible.

Today’s infographic from Halo Investing explains what structured notes are, outlines the two main types, and demonstrates how to implement them in a portfolio.

What is a Structured Note?

A structured note is a hybrid security, where approximately 80% is a bond component and 20% is an embedded derivative.

Structured notes are issued by major financial institutions. Since they are the liability of the issuer, it is critical that the investor is comfortable with the issuer—as with any bond purchase.

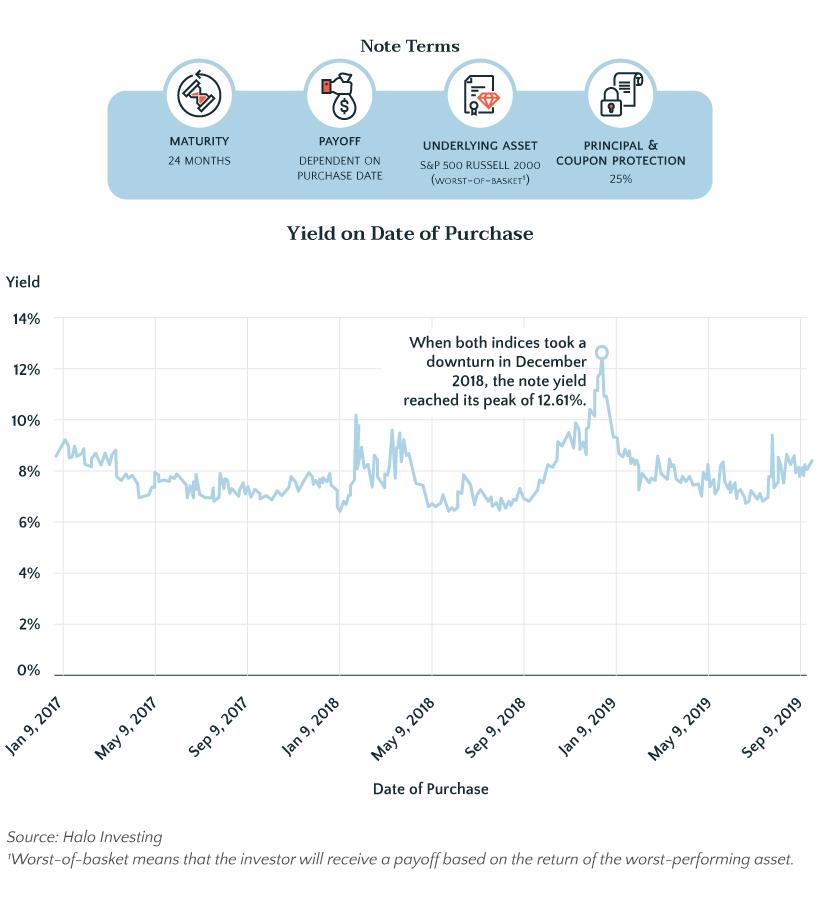

Almost all structured notes have four simple parameters.

- Maturity – The term typically falls within 3 to 5 years.

- Payoff – The amount the investor receives at maturity.

- Underlying asset – The note’s performance is linked to the price return (excluding dividends) of an asset, such as stocks, ETFs, or foreign currencies.

- Protection – The level of protection the investor receives if the underlying asset loses value.

As long as the underlying asset does not fall lower than the protection amount at maturity, the investor will receive their initial investment back in full.

This is the primary draw of structured notes: they provide a level of downside protection, while still allowing investors to participate in market upswings.

Types of Structured Notes

There are a variety of structured notes, providing investors with diverse options and a range of risk/return profiles. Structured notes generally fall into one of two broad categories: growth notes and income notes.

Growth Notes

Investors receive a percentage—referred to as the participation rate—of the underlying asset’s price appreciation.

For example, a growth note has the following terms:

- Maturity: 5 years

- Participation rate: 117%

- Underlying asset: S&P 500 index

- Principal protection: 30%

Here’s what the payoff would look like in 4 different scenarios:

| S&P 500 return | Growth Note Return |

|---|---|

| 50% | 58.5% |

| 10% | 11.7% |

| -10% | 0% |

| -50% | -20% |

The S&P 500 can return a loss of up to 30%, the principal protection level in this example, before the note starts to lose value.

Income Notes

Over an income note’s life, investors receive a fixed payment known as a coupon. Income notes do not participate in the upside returns the way a growth note does—but they may generate a higher income stream than a standard debt security or dividend-paying stock.

This is because protection is offered for both the principal and the coupon payments. For example, say a note’s underlying asset is the S&P 500, and it pays an 8% coupon with 30% principal protection. If the S&P 500 trades sideways all year—sometimes slightly negative or positive—the note will still pay its 8% coupon due to the protection.

Income notes have another big advantage: their yields can spike in tumultuous markets, as was demonstrated during the market volatility near the end of 2018.

Why did this spike occur? Banks construct the derivative piece of an income note by selling options*, which are more expensive in volatile markets. Banks then collect these higher premiums, creating larger coupons inside the structured note.

Investors can diversify their return profile by using a combination of growth and income notes.

*Option contracts offer the buyer the opportunity to either buy or sell the underlying asset at a stated price within a specific timeframe. Unlike futures, the buyer is not forced to exercise the contract if they choose not to.

Portfolio Applications

Structured notes are powerful tools that can accomplish almost any investment goal, and investors commonly use them as a core portfolio component.

- Step 1: Select a portfolio asset class where downside protection is desired.

- Step 2: Reallocate a portion of the asset class to a structured note

- Step 3: Improve risk/reward performance.

The asset class will demonstrate an enhanced return profile, with less downside risk.

A Global Market

While relatively small in the Americas, the structured notes market is growing on a global scale:

| Region | AUM (2019 Q2) |

|---|---|

| Americas | $434B |

| Europe | $526B |

| Asia Pacific | $1,066B |

In the first half of 2019, assets under management in the Americas was up by 4%. It’s clear the asset class presents enormous untapped potential—and investors are taking notice.

Lowering Barriers Through Technology

Technology is becoming more ingrained in wealth management—empowering investors to access structured notes more easily through efficient trading.

The market is already becoming more accessible. By 31 October 2019, the average transaction size had decreased by almost $500,000 over the year prior.

Technology also offers other benefits for investors:

- Improved analytics

- Investment education

- Risk information

- Increased competition = lower fees

- Improved secondary liquidity

As more investors take advantage of this asset class, they may be able to improve their return potential while limiting their risk.