Shifting Perspectives: The World’s Top Financial Centers

Financial centers are catalysts for global growth, with tremendous economic influence.

Historically, the rise of nations has coincided with the emergence of robust financial hubs. From London towering in the 19th century, to New York City gaining dominance in the 20th century, broader economic shifts are at play.

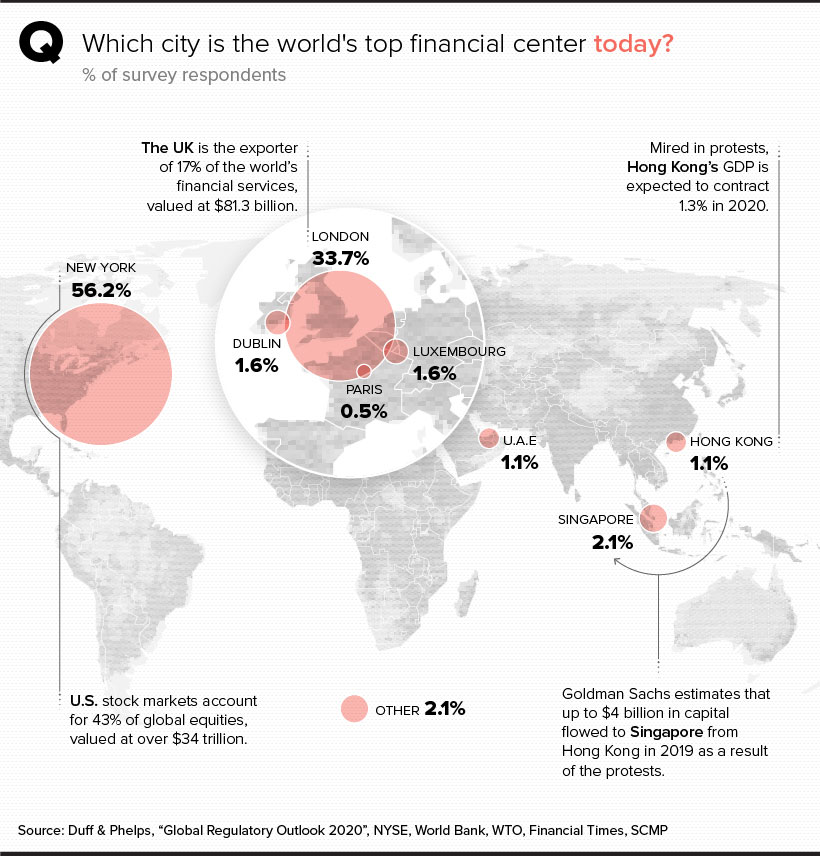

Today’s chart uses data from the Duff & Phelps Global Regulatory Outlook 2020, and it highlights changing perceptions on the world’s financial centers.

In total, 240 senior financial executives were surveyed—we take a look at their responses, as well as key factors that could impact perspectives across the wider financial landscape.

Financial Hubs Today

In the below graphic, you can see the percentage of respondents that voted for each city as the world’s preeminent financial center:

The Status Quo

New York and London are perceived to be at the helm of the financial world today.

New York City is home to the two largest stock exchanges in the world—and altogether, U.S. stock markets account for an impressive 43% of global equities, valued at over $34 trillion. Of course, New York is also home to many of the world’s investment banks, hedge funds, private equity firms, and global credit rating agencies.

Across the pond, the London Stock Exchange has surpassed $5 trillion in market capitalization, and the city has been a global financial hub since the LSE was founded more than 200 years ago.

Together, the United States and the United Kingdom account for 40% of the world’s financial exports. But while New York City and London have a foothold on international finance, other key financial centers have also established themselves.

Rising in the East

Singapore, accounting for 2.1% of the respondents’ vote, is considered the best place to conduct business in the world.

Meanwhile, seventh-ranked Hong Kong is regarded highly for its separation of executive, judiciary, and legislative powers.

Despite ongoing protests—which have resulted in an estimated $4 billion outflow of funds to Singapore—it maintains its status as a vital financial hub globally.

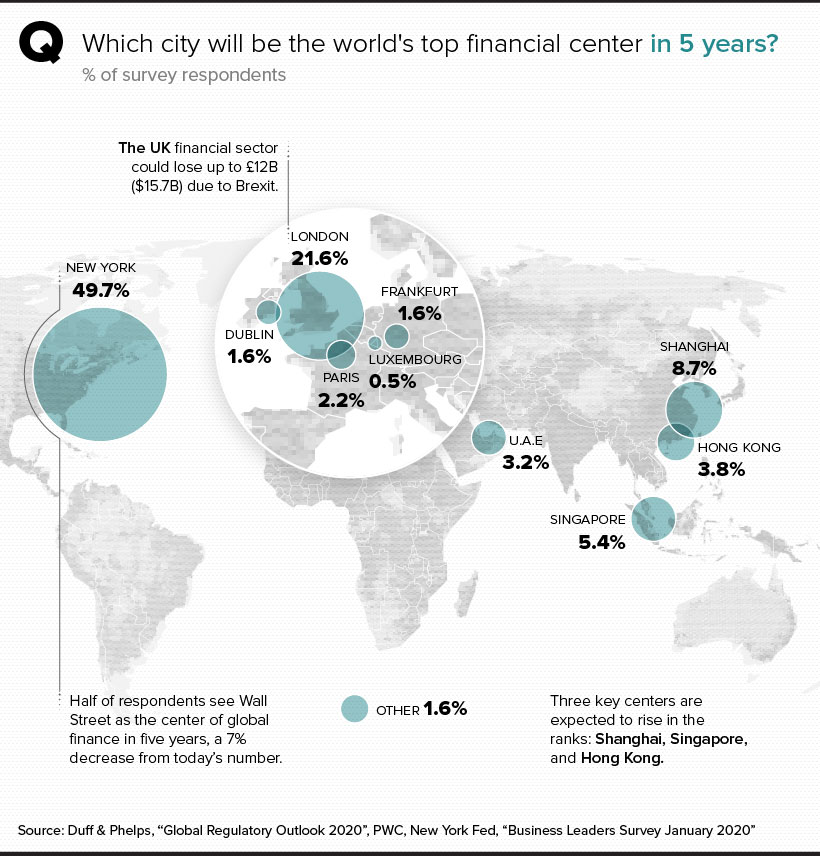

Where are Financial Centers Heading?

A number of core financial hubs are anticipated to underpin the future of finance.

Although New York maintains the top spot, some executives surveyed believe that the top financial center could shift to Shanghai, Singapore, or Hong Kong.

Growth in Asian Hubs

According to survey results, 8.7% of respondents said Shanghai is predicted to be the next global financial hub by 2025. Shanghai houses the largest stock exchange in China, the Shanghai Stock Exchange (SSE), and the SSE Composite tracks the performance of over 1,600 listings with $4.9 trillion in combined market capitalization.

Meanwhile, Singapore accounted for 5.4% of the respondents’ vote. Exporting $27.2 billion in financial services annually, Singapore’s economy has grown at an average clip of 7.7.% per year since the country’s independence, one of the highest growth rates in the world.

The Impending Impact of Brexit

After four tumultuous years, Britain’s departure from Europe took place on January 31, 2020.

Despite a long-awaited victory for the Conservative government, many experts are saying that economic prospects for the region look dim.

We now know that the economy will be between 2—6% smaller in 10 years than it would otherwise have been.

– Ray Burrell, Professor at Brunel University

The UK financial sector could lose over $15 billion (£12B) due to Brexit, and falling investment in the private sector may lead to wage pressure and layoffs.

On the flip side, 51% of UK businesses said that Brexit will be beneficial to business conditions.

A New Paradigm

Although the global financial sector is primarily influenced today by New York City and London, it seems that perceptions are shifting.

While both of these cities will maintain their reputations as massive financial capitals going forward, it’s also clear that hubs such as Singapore, Hong Kong, and Shanghai will be providing some stiff competition for capital.