Historical Returns by Asset Class (1985-2020)

Mirror, mirror, on the wall, is there one asset class to rule them all?

From stocks to bonds to alternatives, investors can choose from a wide variety of investment types. The choices can be overwhelming—leaving people to wonder if there’s one investment that consistently outperforms, or if there’s a predictable pattern of performance.

This graphic, which is inspired by and uses data from The Measure of a Plan, shows historical returns by asset class for the last 36 years.

Asset Class Returns by Year

This analysis includes assets of various types, geographies, and risk levels. It uses real total returns, meaning that they account for inflation and the reinvestment of dividends.

Here’s how the data breaks down, this time organized by asset class rather than year:

| U.S. Large Cap Stocks | U.S. Small Cap Stocks | Int’l Dev Stocks | Emerging Stocks | All U.S. Bonds | High-Yield U.S. Bonds | Int’l Bonds | Cash (T-Bill) | REIT | Gold | |

|---|---|---|---|---|---|---|---|---|---|---|

| Ticker | VFIAX | VSMAX | VTMGX | VEMAX | VBTLX | VWEAX | VTABX | VUSXX | VGSLX | IAU |

| 2020* | 1.5% | -5.5% | -10.3% | -0.7% | 4.9% | -0.5% | 2.6% | -0.7% | -16.4% | 21.9% |

| 2019 | 28.5% | 24.5% | 19.3% | 17.6% | 6.3% | 13.3% | 5.5% | -0.1% | 26.1% | 15.9% |

| 2018 | -6.2% | -11.0% | -16.1% | -16.2% | -1.9% | -4.7% | 1.0% | -0.1% | -7.7% | -3.2% |

| 2017 | 19.3% | 13.8% | 23.8% | 28.7% | 1.4% | 4.9% | 0.3% | -1.3% | 2.8% | 9.3% |

| 2016 | 9.7% | 15.9% | 0.4% | 9.5% | 0.5% | 9.0% | 2.5% | -1.8% | 6.3% | 6.6% |

| 2015 | 0.6% | -4.3% | -0.9% | -16.0% | -0.3% | -2.0% | 0.3% | -0.7% | 1.6% | -12.3% |

| 2014 | 12.8% | 6.7% | -6.4% | -0.2% | 5.1% | 3.9% | 8.0% | -0.7% | 29.3% | -1.2% |

| 2013 | 30.4% | 35.8% | 20.3% | -6.4% | -3.6% | 3.1% | -0.4% | -1.5% | 0.9% | -29.0% |

| 2012 | 14.0% | 16.2% | 16.5% | 16.8% | 2.4% | 12.5% | 4.5% | -1.7% | 15.7% | 6.5% |

| 2011 | -0.9% | -5.5% | -15.0% | -21.0% | 4.6% | 4.2% | 0.8% | -2.9% | 5.5% | 5.5% |

| 2010 | 13.4% | 26.0% | 6.8% | 17.2% | 5.0% | 10.9% | 1.7% | -1.5% | 26.6% | 26.0% |

| 2009 | 23.3% | 32.7% | 24.9% | 71.5% | 3.2% | 35.6% | 1.6% | -2.4% | 26.3% | 20.2% |

| 2008 | -37.0% | -36.1% | -41.3% | -52.8% | 5.1% | -21.3% | 5.5% | 2.0% | -37.0% | 5.4% |

| 2007 | 1.3% | -2.7% | 6.8% | 33.6% | 2.8% | -1.8% | 0.1% | 0.7% | -19.7% | 25.8% |

| 2006 | 12.9% | 12.9% | 23.1% | 26.3% | 1.8% | 5.7% | 0.5% | 2.1% | 31.8% | 19.3% |

| 2005 | 1.4% | 3.9% | 9.8% | 27.7% | -0.9% | -0.5% | 1.8% | -0.5% | 8.3% | 13.0% |

| 2004 | 7.3% | 16.2% | 16.5% | 22.1% | 1.0% | 5.2% | 1.8% | -2.0% | 26.7% | 1.4% |

| 2003 | 26.2% | 43.1% | 36.1% | 54.7% | 2.1% | 15.1% | 0.4% | -0.9% | 33.3% | 19.2% |

| 2002 | -23.9% | -21.8% | -17.6% | -9.6% | 5.8% | -0.6% | 4.2% | -0.7% | 1.3% | 20.8% |

| 2001 | -13.3% | 1.6% | -23.1% | -4.4% | 6.8% | 1.3% | 4.6% | 2.6% | 10.7% | -0.4% |

| 2000 | -12.0% | -5.8% | -17.1% | -29.9% | 7.7% | -4.1% | 5.4% | 2.5% | 22.2% | -9.6% |

| 1999 | 17.9% | 19.9% | 23.6% | 57.3% | -3.4% | -0.2% | -0.6% | 2.0% | -6.5% | -1.7% |

| 1998 | 26.6% | -4.2% | 18.0% | -19.4% | 6.9% | 3.9% | 10.2% | 3.5% | -17.7% | -2.4% |

| 1997 | 31.0% | 22.5% | 0.0% | -18.2% | 7.6% | 10.0% | 8.9% | 3.5% | 16.8% | -23.2% |

| 1996 | 18.9% | 14.3% | 2.6% | 12.1% | 0.3% | 6.0% | 8.3% | 1.9% | 31.4% | -7.7% |

| 1995 | 34.0% | 25.6% | 8.4% | -1.9% | 15.3% | 16.2% | 14.3% | 3.1% | 10.0% | -1.7% |

| 1994 | -1.5% | -3.1% | 4.9% | -10.1% | -5.2% | -4.3% | -7.3% | 1.3% | 0.4% | -4.9% |

| 1993 | 7.0% | 15.5% | 28.9% | 69.4% | 6.7% | 15.1% | 10.7% | 0.2% | 16.3% | 13.9% |

| 1992 | 4.4% | 14.9% | -14.7% | 7.8% | 4.1% | 11.0% | 3.3% | 0.6% | 11.2% | -8.7% |

| 1991 | 26.3% | 40.9% | 8.7% | 54.5% | 11.8% | 25.2% | 7.5% | 2.5% | 31.5% | -12.5% |

| 1990 | -8.9% | -22.8% | -27.9% | -16.1% | 2.4% | -11.3% | -2.7% | 1.6% | -20.3% | -8.3% |

| 1989 | 25.5% | 11.0% | 5.6% | 56.9% | 8.6% | -2.6% | -0.6% | 3.7% | 3.9% | -6.8% |

| 1988 | 11.3% | 19.7% | 22.8% | 33.9% | 2.8% | 8.8% | 4.4% | 2.1% | 8.6% | -19.6% |

| 1987 | 0.3% | -12.7% | 19.3% | 9.3% | -2.8% | -1.7% | 4.5% | 1.3% | -7.8% | 19.0% |

| 1986 | 16.8% | 4.5% | 67.5% | 10.4% | 13.9% | 15.6% | 10.1% | 5.0% | 17.7% | 17.9% |

| 1985 | 26.4% | 26.2% | 50.3% | 22.9% | 17.6% | 17.5% | 7.0% | 3.8% | 14.6% | 1.7% |

*Data for 2020 is as of October 31

The top-performing asset class so far in 2020 is gold, with a return more than four times that of second-place U.S. bonds. On the other hand, real estate investment trusts (REITs) have been the worst-performing investments. Needless to say, economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate.

Over time, the order is fairly random with asset classes moving up and down the ranks. For example, emerging market stocks plummeted to last place amid the global financial crisis in 2008, only to rise to the top the following year. International bonds were near the bottom of the barrel in 2017, but rose to the top during the 2018 market selloff.

There are also large swings in the returns investors can expect in any given year. While the best-performing asset class returned just 1% in 2018, it returned a whopping 71.5% in 2009.

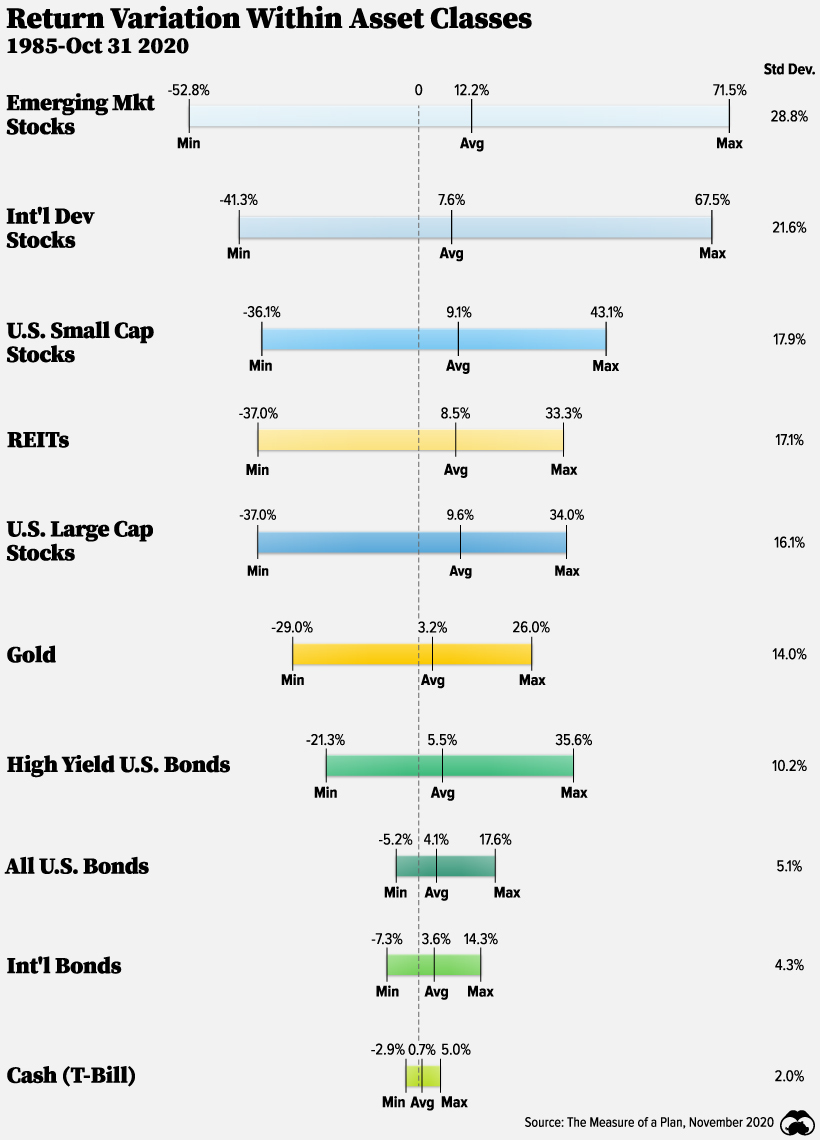

Variation Within Asset Classes

Within individual asset classes, the range in returns can also be quite large. Here’s the minimum, maximum, and average returns for each asset class. We’ve also shown each investment’s standard deviation, which is a measure of volatility or risk.

Although emerging market stocks have seen the highest average return, they have also seen the highest standard deviation. On the flip side, T-bills have seen returns lower than inflation since 2009, but have come with the lowest risk.

Investors should factor in risk when they are looking at the return potential of an asset class.

Variety is the Spice of Portfolios

Upon reviewing the historical returns by asset class, there’s no particular investment that has consistently outperformed. Rankings have changed over time depending on a number of economic variables.

However, having a variety of asset classes can ensure you are best positioned to take advantage of tailwinds in any particular year. For instance, bonds have a low correlation with stocks and can cushion against losses during market downturns.

If your mirror could talk, it would tell you there’s no one asset class to rule them all—but a mix of asset classes may be your best chance at success.