Government Debt by Country, in Advanced Economies

The amount of debt a government holds is a crucial indicator for the sustainability of its finances.

If the debt is excessively high—especially as a percentage of gross domestic product (GDP)—it may signal challenges in meeting financial obligations, potentially leading to economic instability.

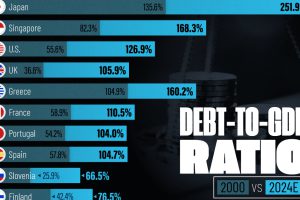

This graphic ranks government debt by country for advanced economies, using their gross debt-to-GDP ratio. The ranking is based on IMF Outlook from October 2023.

Debt-to-GDP Ratio for Advanced Economies in 2023

From 20 economies analyzed, 11 have a debt-to-GDP ratio of over 100%.

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023.

| Economy by Gross Debt | % of GDP (2023) |

|---|---|

| 🇯🇵 Japan | 255% |

| 🇬🇷 Greece | 168% |

| 🇸🇬 Singapore | 168% |

| 🇮🇹 Italy | 144% |

| 🇺🇸 United States* | 123% |

| 🇫🇷 France | 110% |

| 🇵🇹 Portugal | 108% |

| 🇪🇸 Spain | 107% |

| 🇨🇦 Canada* | 106% |

| 🇧🇪 Belgium | 106% |

| 🇬🇧 United Kingdom | 104% |

| 🇨🇾 Cyprus | 79% |

| 🇦🇹 Austria | 75% |

| 🇫🇮 Finland | 74% |

| 🇸🇮 Slovenia | 69% |

| 🇩🇪 Germany | 66% |

| 🇭🇷 Croatia | 64% |

| 🇮🇸 Iceland | 61% |

| 🇮🇱 Israel | 58% |

| 🇸🇰 Slovak Republic | 57% |

| 🌎 G7 Average | 128% |

*For the U.S. and Canada, gross debt levels were adjusted to exclude unfunded pension liabilities of government employees’ defined-benefit pension plans.

Japan has indeed been borrowing heavily, though mainly in the form of intergovernmental holdings with interest rates around 0%. However, with the country experiencing a rapidly aging population, an increasing burden of social security expenses could lead to an even larger fiscal deficit in the future.

The U.S. national debt hit $32 trillion in 2023, making up 123% of the country’s GDP. To put it in perspective, two decades ago, the U.S. debt-to-GDP ratio was less than half of what it is today. Nonetheless, it remains below the G7 average of 128%.

Germany’s ratio of 66% is the lowest in the G7, though it climbed following the COVID-19 pandemic. All EU member states attempt to keep their ratios below 60% for stability. Otherwise, when debt grows beyond what countries can pay, emergency bailouts and defaults lead to economies crashing, as seen in the European debt crisis from 2009 to 2014.

However, a high gross debt-to-GDP ratio (over 100%) is not always a cause for concern. Net ratios that take intergovernmental holdings into account can indicate exposure to debt better in the short-term, as does comparing liabilities and assets. The question is, where are debt ratios heading in the future?