Mapping Affordability in the Epicenter of Canada’s Housing Bubble

At the epicenter of Canada’s housing bubble, which is now rated as the most overvalued in the world, is the west coast city of Vancouver. It’s there that low interest rates and foreign buying have fueled the average detached home price to a record of C$1.47 million, a 20% increase from the previous year.

While there are many measures of unaffordability, the government and federal agencies frequently use one such measure called the Shelter-cost to Income Ratio. It essentially compares the annual cost of an individual’s housing with the amount of income they have coming in each year. Federal agencies in Canada consider households that spend 30% or more of total before-tax household income on shelter expenses to have a “housing affordability” problem.

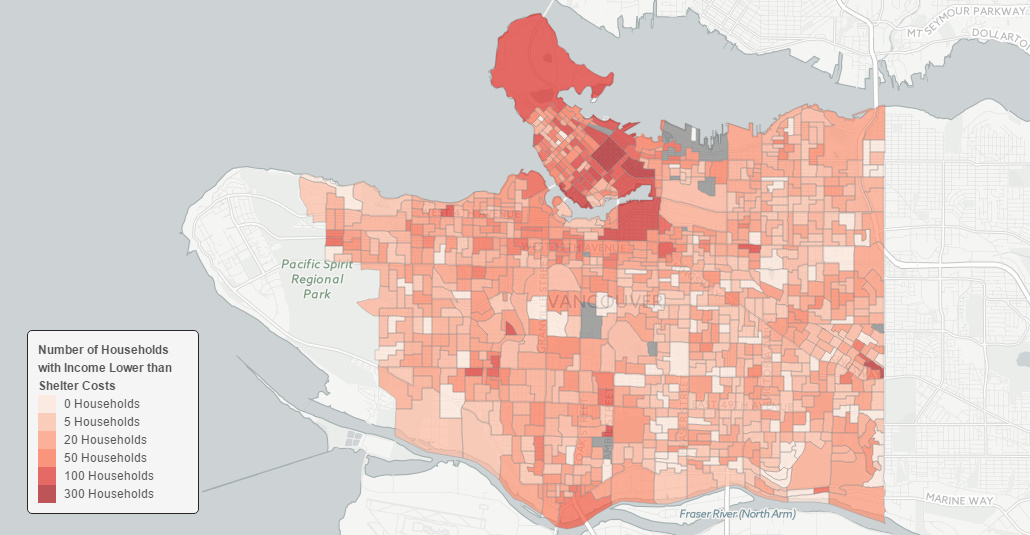

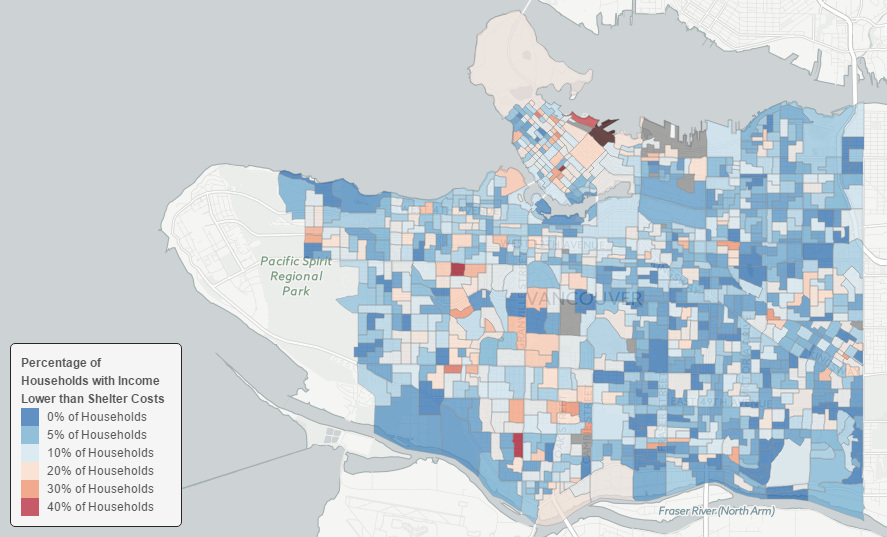

In Vancouver, however, the city has become so unaffordable that 25,000 households pay more for their shelter costs than their entire declared income. This works out to 9.5% of the households in the city – far higher than Greater Toronto (5.9%) or Montreal (5%).

We recently stumbled across a data mapping project by Jens von Bergmann, via the Hongcouver blog. Von Bergmann, who runs a data firm in Vancouver, has compiled a series of interactive maps that overlay census data onto the city. In Canada, the mandatory census happens every five years and creates a wealth of granular information.

Here’s the percent of people in each city block that pay more for housing than they take home in income:

In an example neighborhood pocket (dissemination area 59150581) located between Arbutus and Macdonald streets, 44.8% of households pay more for shelter than they bring in for income. The average value for each “shelter”? A cool C$1.98 million. Yet, the median individual income in the area is only C$19,993.

Things get stranger yet in Vancouver’s high-end Coal Harbour neighborhood, where somehow 62% of households claim to have lower income than shelter costs. In a pocket of Yaletown, 50% of people make less than the cost of their housing.

While the precision of the data is excellent, the only problem with it is that the last census in Canada took place in 2011. Four years ago, housing prices were a fraction of what they are today. Compare today’s price of a detached home (C$1.47 million) to the price in August 2011: C$888,243.

Have median wages jumped this much? Not likely – the problem is only getting worse.

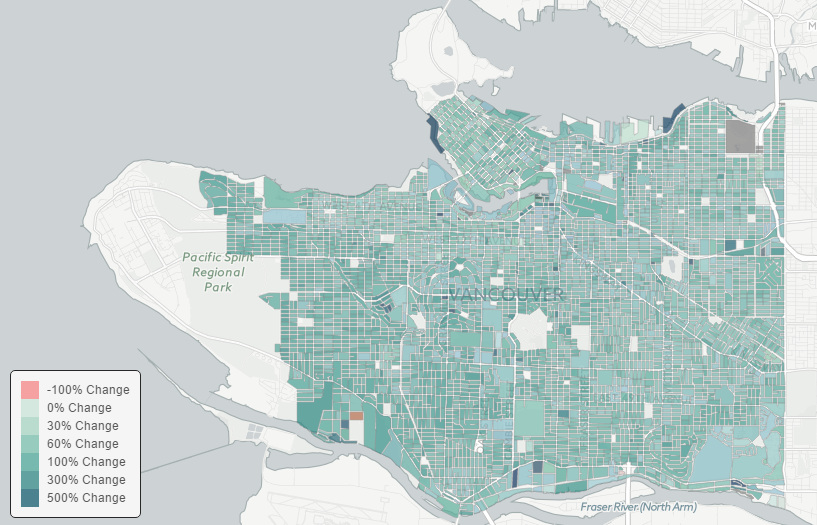

Here’s how the value of land has changed by block from 2006 to 2014 according to some of von Bergmann’s other data based on City of Vancouver assessment records:

Despite the country entering a technical recession, consumers having record-high debt, and commodity markets getting routed, Vancouver’s market is still flying high today.

Housing sales in August 2015 were up 28% compared to the ten-year average, and the median price in Vancouver’s west side is entering “crazy” territory at C$2.87 million. While it is true that shelter in the epicenter of Canada’s housing bubble may seem quite expensive, at least the homes don’t look like crack shacks. Or do they?