How Many Music Streams Does it Take to Earn a Dollar?

A decade ago, the music industry was headed for a protracted fade-out.

The disruptive effects of peer-to-peer file sharing had slashed music revenues in half, casting serious doubts over the future of the industry.

Ringtones provided a brief earnings bump, but it was the growing popularity of premium streaming services that proved to be the savior of record labels and artists. For the first time since the mid-90s, the music industry saw back-to-back years of growth, and revenues grew a brisk 12% in 2018 – nearly reaching $10 billion. In short, people showed they were still willing to pay for music.

Although most forecasts show streaming services like Spotify and Apple Music contributing an increasingly large share of revenue going forward, recent data from The Trichordist reveals that these services pay out wildly different rates per stream.

Note: Due to the lack of publicly available data, calculating payouts from streaming services is not an exact science. This data set is based on revenue from an indie label with a ~150 album catalogue generating over 115 million streams.

Full Stream Ahead

One would expect streaming services to have fairly similar payout rates every time a track is played, but this is not the case. In reality, the streaming rates of major players in the market – which have very similar catalogs – are all over the map. Below is a full breakdown of how many streams it takes to earn a dollar on various platforms:

| Streaming service | Avg. payout per stream | # of streams to earn one dollar | # of streams to earn minimum wage* |

|---|---|---|---|

| Napster | $0.019 | 53 | 77,474 |

| Tidal | $0.0125 | 80 | 117,760 |

| Apple Music | $0.00735 | 136 | 200,272 |

| Google Play Music | $0.00676 | 147 | 217,751 |

| Deezer | $0.0064 | 156 | 230,000 |

| Spotify | $0.00437 | 229 | 336,842 |

| Amazon | $0.00402 | 249 | 366,169 |

| Pandora** | $0.00133 | 752 | 1,106,767 |

| YouTube | $0.00069 | 1,449 | 2,133,333 |

*U.S. monthly minimum wage of $1,472 **Premium tier

Napster, once public enemy number one in the music business, has some of the most generous streaming rates in the industry. On the downside, the brand currently has a market share of less than 1%, so getting a high volume of plays on an album isn’t likely to happen for most artists.

On the flip side of the equation, YouTube has the highest number of plays per song, but the lowest payout per stream by far. It takes almost 1,500 plays to earn a single dollar on the Google-owned video platform.

Spotify, which is now the biggest player in the streaming market, is on the mid-to-low end of the compensation spectrum.

The Payment Pipeline

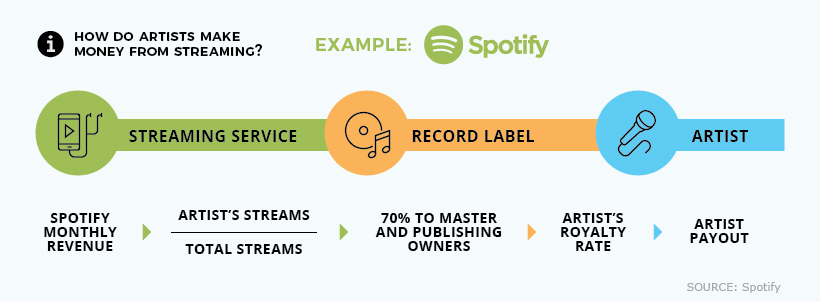

How do companies like Spotify calculate the amount paid out to license holders? Here’s a look at their payout process:

As this chart reveals, dollars earned from streaming still don’t tell the full story of how much artists receive at the end of the line. This amount is influenced by whether or not the performer has a record deal, and if other contributors have a stake in the recorded work.

The Pressure is Heating Up

When Spotify was a scrappy startup providing a much needed revenue stream to the music industry, labels were temporarily willing to accept lower streaming rates.

But now that Spotify is a public company, and tech giants like Apple and Amazon are in the picture, a growing chorus of industry players will likely dial up the pressure to increase compensation rates.