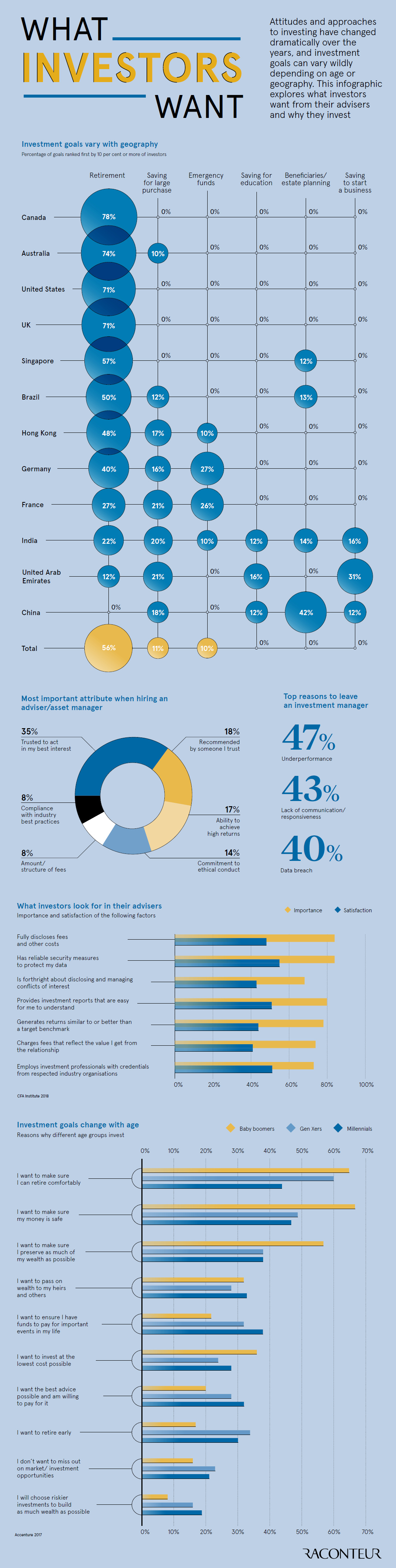

How Investment Goals Vary by Country and Age

It goes without saying that investors want to see their money grow.

However, it turns out that why investors want their money to grow changes considerably, depending on who you are talking to.

Investment Goals by Geography

Today’s infographic from Raconteur first shows why people invest based on country of residence.

In the following table, we’ll show selected data to illustrate an interesting contrast between North American, Asian, and European cultures:

| Country | Primary Investing Goal | Percentage |

|---|---|---|

| Canada | Saving for retirement | 78% |

| USA | Saving for retirement | 71% |

| UK | Saving for retirement | 71% |

| Hong Kong | Saving for retirement | 48% |

| Germany | Saving for retirement | 40% |

| France | Saving for retirement | 27% |

| UAE | Saving to start a business | 31% |

| China | Beneficiaries / estate planning | 42% |

In Canada, the United States, and the United Kingdom, saving for retirement is the primary investment goal for 70% or more of all respondents. However, in Europe and Asia, there is a much wider diversity of investment goals.

In Germany and France, for example, close to a quarter of respondents mentioned that saving for an emergency was their primary goal, behind saving for retirement. Meanwhile, in the UAE and in China, the primary investment goal was not retirement – it was instead saving to start a business (UAE) and setting up family and/or beneficiaries for success (China).

Goals by Generation

It’s not just geographical boundaries, the level of economic development, and the local culture that impacts investment goals.

Another factor is generational: Baby Boomers, Gen Xers, and Millennials are at very different stages of life, and each generation has their own quirky preferences, anyway.

| Statement (I want to…) | Highest Agreeance | Lowest agreeance |

|---|---|---|

| Retire comfortably | Boomers | Millennials |

| Make sure money is safe | Boomers | Millennials |

| Preserve as much wealth as possible | Boomers | Millennials |

| Pass on wealth to my heirs and others | Millennials | Gen Xers |

| Ensure I have funds to pay for important events | Millennials | Boomers |

| Invest at the lowest cost possible | Boomers | Gen Xers |

| Have the best advice possible and am willing to pay | Millennials | Boomers |

| Retire early | Gen Xers | Boomers |

| Not miss out on market opportunities | Gen Xers | Boomers |

| Choose riskier investments to build wealth fast | Millennials | Boomers |

Not surprisingly, as people get older, their goals shift away from making immediate big-ticket purchases, and holding riskier investments for a higher rate of return. Later on in life, goals are more focused on retirement and maximizing wealth.

That said, there are some anomalies in the above data that are interesting.

For example, Millennials – not Baby Boomers – are most concerned about building wealth to pass onto their heirs. Finally, it is the Millennials that are willing to pay the most for investment advice, in order to get the best possible result.