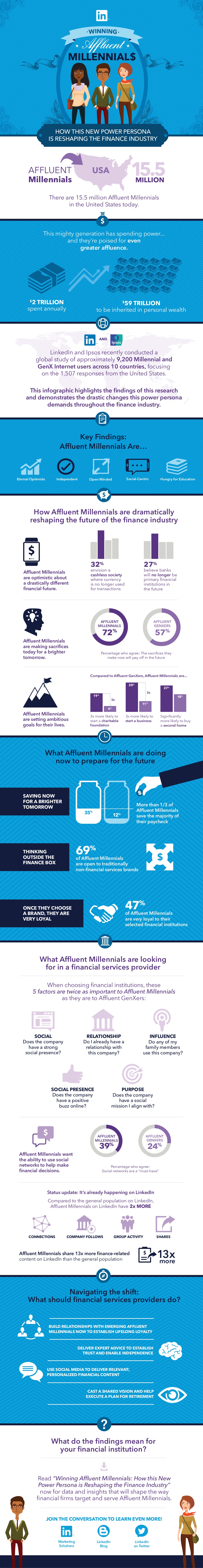

How Affluent Millennials are Changing the Finance Industry

We previously showed a set of nine charts that show the views of Millennials on debt, banking, and investing. We also recently showed what Millennials want in a first home.

Today’s infographic follows a similar thread, looking at the values of the 15.5 million affluent Millennials in the United States, and what the finance industry will have to do to appeal to this group.

Probably the most important fact worth considering is the sheer wealth that this group will command as they inherit money from the Baby Boomer generation. To start, they already control $2 trillion of spending power each year. However, it is estimated that when it is all said and done, they will command an additional $59 trillion in net worth with inheritances.

Through a survey conducted by LinkedIn and Ipsos Reid, the biggest finding about this group was that they view finance and banking differently. Most Millennials (69%) are open to non-traditional finance brands, while 32% view the future as being a cashless society and 27% hold a view that big banks will not be the primary financial institutions in the future. (Note: we previously also looked at the tech startups that are aiming to disrupt these dinosaur institutions.)

Even more important is that Millennials made it clear they are looking for a social connection to these institutions. They want a brand that they believe does good for the world, rather than just raking in bank fees and profits. For this, finance will have to change: it’s not just about being good with money anymore.

Millennials want their brands to align with their purpose and to be a part of their self-actualization.

Original graphic by: LinkedIn