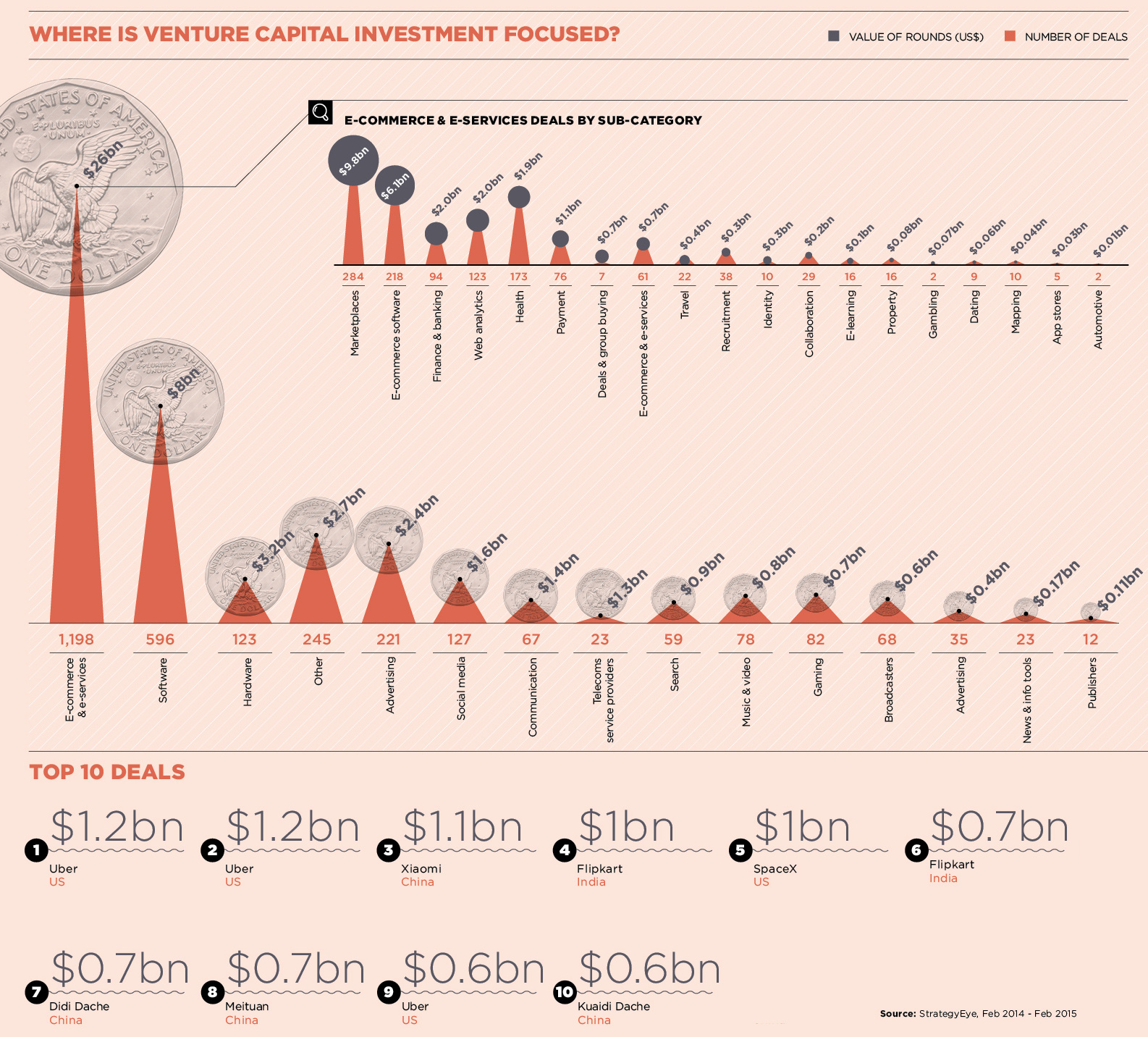

Deal Flow: The Technologies Receiving the Most Investment from VCs

Angel investors and venture capitalists put up with a lack of liquidity in there investments for a good reason. The ability to fund private, early-stage ventures allows these investors to get a pulse on industry trends before they fully materialize in front of the general public. If they play their cards right, it allows this group to get in on an Uber or an Airbnb years before anyone even knows it exists to receive a lucrative return.

Those in the retail crowd should play close attention. The sectors that are receiving the most private investment today may be coming down the pipeline through the next IPO or RTO to a market near you.

The above infographic highlights some of the technologies receiving the most investment last year, taking into account deal flow between February 2014 and February 2015. Notable investment areas in dollar terms continue to include Marketplaces ($9.8 bn) and E-commerce software ($6.1 bn). The Health sector was also hot (175 deals to a tune of $1.9 bn) along with the Finance and Payments segments.

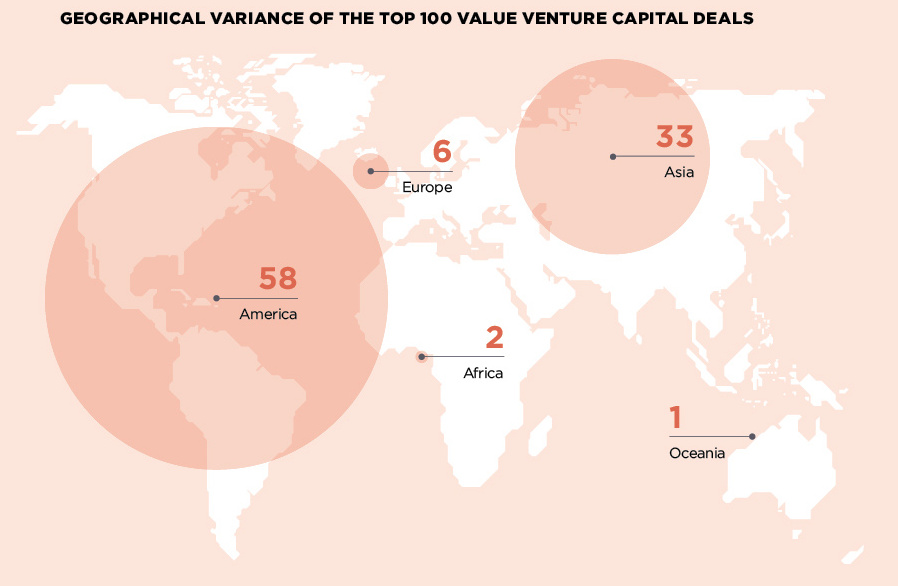

Here’s the geographic breakdown of venture capital by continent:

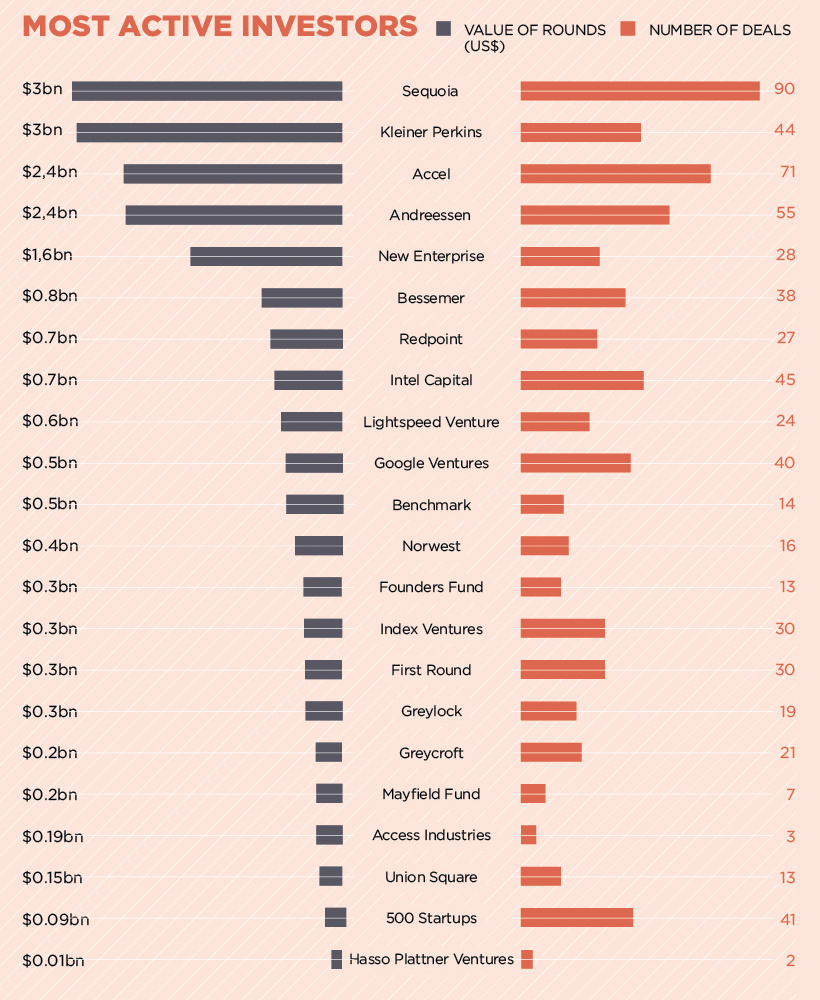

Lastly, the majority of deals were led by the same usual suspects such as Sequoia, KPCB, and Andreessen Horowitz.:

Original graphic by: Raconteur