![Commodity Scoreboard: Uranium and Silver Led the Way in Q1 [Chart]](https://datamakerich.com/wp-content/uploads/news/commodity-scoreboard-uranium-and-silver-led-the-way-in-q1-chart/0000.png)

Commodity Scoreboard: Uranium and Silver Led the Way in Q1 [Chart]

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

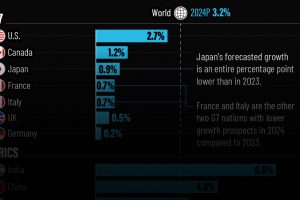

The overall commodities market (S&P GSCI) tanked -5.1% in Q1, weighed on by fossil fuels with oil and natural gas down -11.7% and -7.1% respectively. However, it was a different energy-related commodity that had the last laugh.

Uranium quietly led the pack in Q1 with an impressive 11.6% gain. It is trading close to the $40 per pound level, which is a sizable increase from the $30 level it was trading at last summer. JPMorgan sees the price averaging $42 this year, and moving to a spot price of $50 in 2016.

On the precious metals front, the gold/silver ratio fell to a low of 70 near the end of March, with silver up 5.7% on Q1 in total. Recent movement has brought this back to closer to the 73 level.

Gold had finished flat in the quarter in USD, but as many market commentators have noted, it is actually appreciating in value versus the majority of currencies. It is the relative strength of the USD that is concealing this stealth bull market in the yellow metal.

Oil, which struggled the most in Q1 and bottomed in early March, has seen some life recently as the decrease in rig count has started to “taper”. That said, there is still vast oversupply in especially the US market with production in America at its highest level since 1972.