What Goes Up, Must Come Down

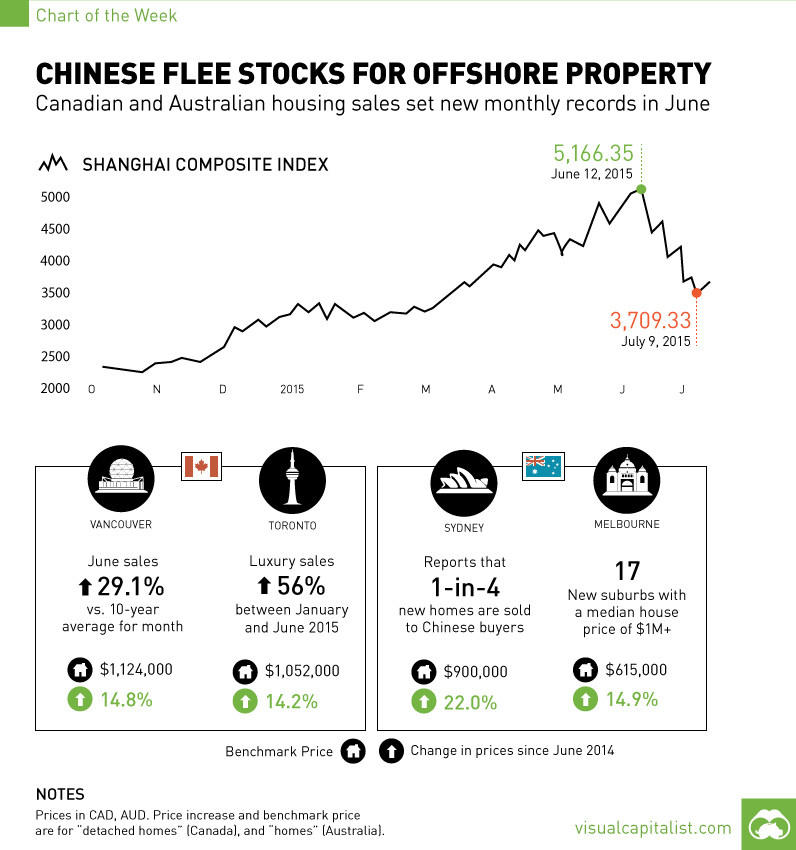

There’s no doubt that China’s market has been a roller coaster as of late. A year ago, the Shanghai Stock Exchange Composite Index was at close to 2,000 points. However, by June 12, 2015, it skyrocketed to a peak of 5166.35, creating trillions of dollars of paper wealth.

From there, participants in the market have had their will tested, as the market suddenly corrected by dropping 30% in the course of one month.

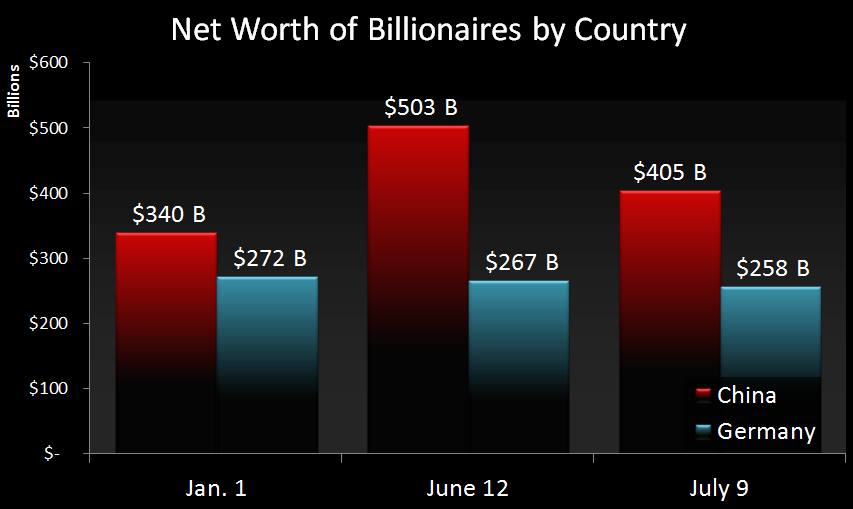

The Bloomberg Billionaires Index tracks the world’s 400 richest people in the world, including 26 from mainland China. Taking a look at the value of their portfolios can provide some insight as to the ride they are on. Here’s the change in wealth of billionaires in China versus those in Germany for this year:

China’s ultra wealthy were up 35% from the start of the year in late May and early June. Then the market crash hit, reeling in their gains to just 10%.

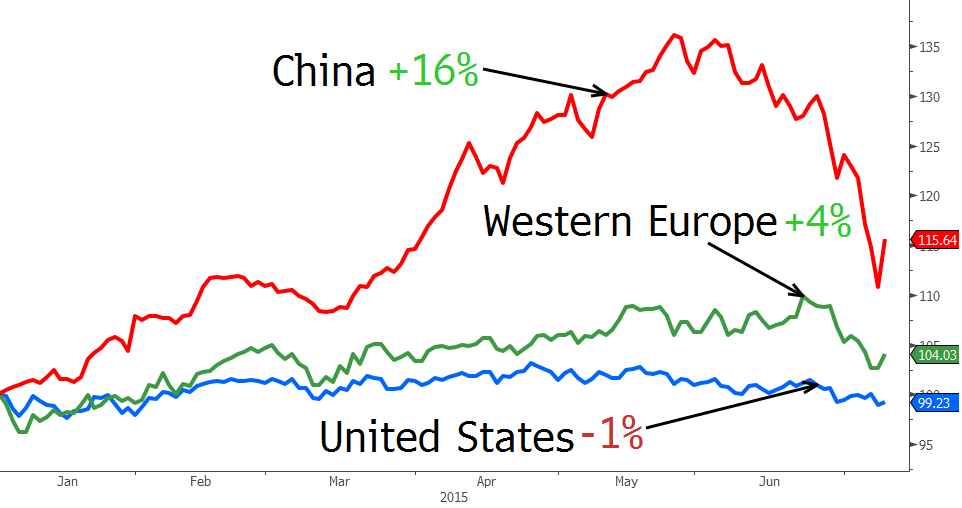

Since then, the stock market has had a bit of a bounce, bringing gains year-to-date to 16% as of last week:

The portfolios of billionaires in the United States and Western Europe are boring in comparison. The wealthiest people in the United States have lost 1% so far in 2015, and those in Western Europe fared better with a 4% increase.

Here’s the whipsaw stories of two Chinese billionaires:

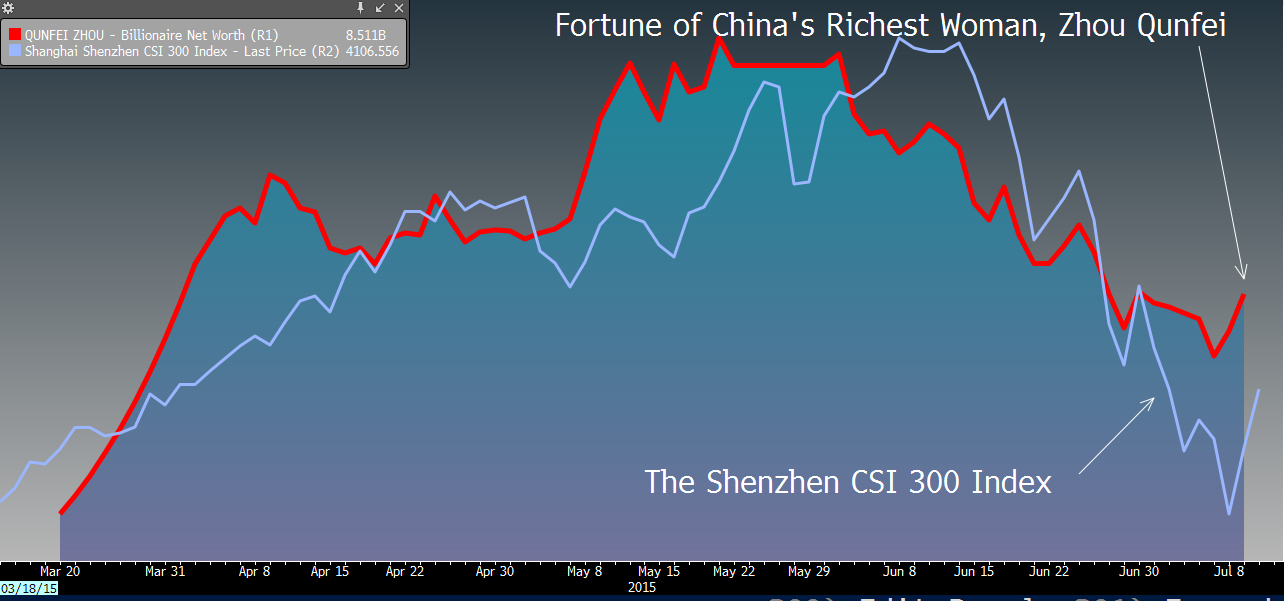

Zhou Qunfei

Zhou Qunfei is China’s richest woman and serves as the chairman of consumer electronics supplier Lens Technology Co Ltd.

Zhou’s fortune soared when Lens Technology IPO’d earlier in the year, as the stock jumped 500% in early trading. Her fortune went up to $10 billion in a matter of months. Then, with the June crash, 40% of her fortune was erased as it decreased by $5 billion.

Pan Sutong

Pan Sutong is the Chinese-born chairman of the Goldin Group, a conglomerate based in Hong Kong. In January, Pan Sutong had $3.7 billion in wealth. Stock in Goldin’s subsidiaries soared, and Mr. Sutong had increased his fortune to peak at an impressive $25 billion.

Since then, the stocks have gotten crushed, bringing him back to where he started: $4 billion.

The Implications of the See-Saw

Most investors in the Chinese markets are “mom and pop” investors – Credit Suisse thinks that 80% of urban Chinese have money in stocks, and many of them don’t even have a high school education. Because of this, there is likely to still be strong volatility as this new group of investors collectively learns how to trade in the market.

China’s ultra rich, meanwhile, are trying to lock in their gains by diversifying elsewhere. This is because the wealthiest people in the country have an unusual amount of wealth tied to public markets compared to the rest of the world: 66% of the wealth of billionaires in China and Hong Kong is “paper wealth” in the public markets.

In the United States and Western Europe, it is less than 50%.

To even out their portfolios, the ultra wealthy have sought out real estate both in China and in foreign markets. This is something we covered out in a recent Chart of the Week as Chinese investors left the volatile stock market in search for a better store of wealth.

See below:

Original graphics from: Bloomberg