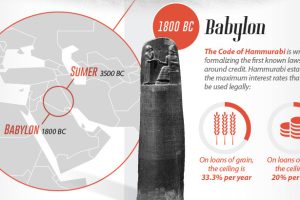

From the writings of antiquity to the innovations that fueled the modern debt boom, we look at the history of consumer credit in this massive infographic. Read more

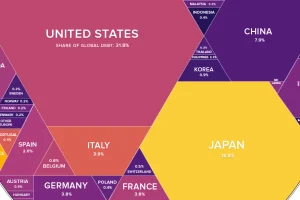

How much debt has been racked up by governments? This stunning infographic shows each country’s share of world debt, along with their debt-to-GDP ratio. Read more

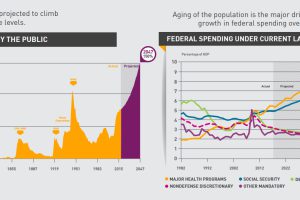

The national debt keeps growing and growing. But what’s driving that trend, and when will the situation reach a critical mass of attention? Read more

The traditional credit score is becoming obsolete – and now, big data and new tech are already starting to shape the modern credit landscape. Read more

Massive amounts of data, the use of biometrics, the fintech boom, and neural networks are just some trends shaping the future of consumer credit. Read more

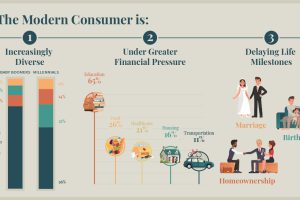

We all have a stereotypical image of the average consumer – but is it an accurate one? Meet the modern consumer, and what it means for business. Read more

See how consumer credit has evolved through the ages — from its ancient origins, to the use of game-changing technologies like artificial intelligence. Read more

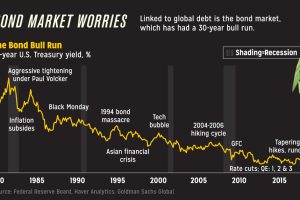

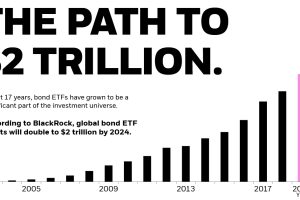

Bonds are a staple in every portfolio, but up until recently were hard to own. Here’s how bond ETFs changed that, reaching $1 trillion in global AUM. Read more

Last year, the global banking industry cashed in an impressive $1.36 trillion in profits. Here’s where they made their money, and how it breaks down. Read more