![Canadian Venture Stocks Trade at Lowest Volume in a Decade [Chart]](https://datamakerich.com/wp-content/uploads/news/canadian-venture-stocks-trade-at-lowest-volume-in-a-decade-chart/0000.png)

Canadian Venture Stocks Trade at Lowest Volume in a Decade [Chart]

The last time volume was this low, iphones didn’t exist

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

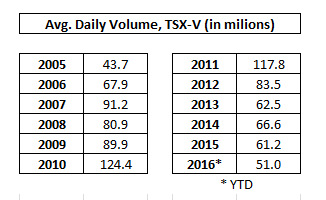

During last year’s plunge in commodity prices, the global benchmark exchange for junior resources recorded its lowest average daily trading volume in over a decade. In fact, the last time volume was this low on Canada’s TSX Venture index was in 2005, before iPhones even existed.

Data for this year is not so hot, either.

With an average of 51 million shares exchanging hands daily in the first 14 trading days of 2016, the volume is 16.6% lower than 2015.

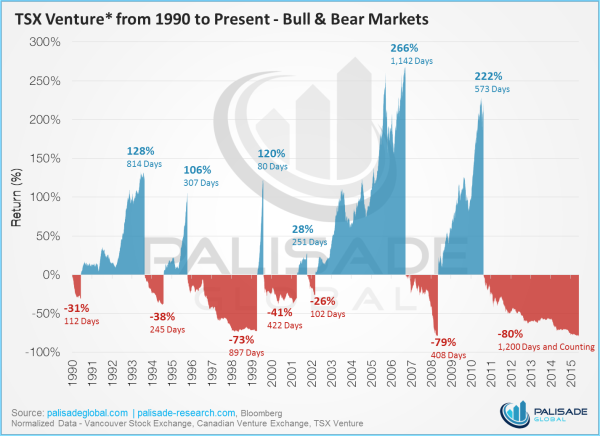

For most people, this is unsurprising, since the Venture index is now in a historic 1,200 day bear market.

Courtesy: Palisade Global

About Face

With no near-term upturn in commodities in sight, the sector finds itself between a rock and a hard place.

The TMX Group, the parent company of the exchange, has even recently published a white paper on ways to potentially revitalize the exchange. Goals of the group include significantly reducing the cost burden on issuers without compromising investor confidence, expanding the base of investors financing companies and enhancing liquidity, and diversifying the stock list to increase the attractiveness of the marketplace.

Critics will argue, however, that the problem of zombie companies cannot be simply solved by any combination of the measures that the TMX Group is willing to take. Reinstatement of the “uptick rule”, reforms on accredited investor regulations, and even bans on short-selling have been proposed by those that argue a greater course of action is needed.