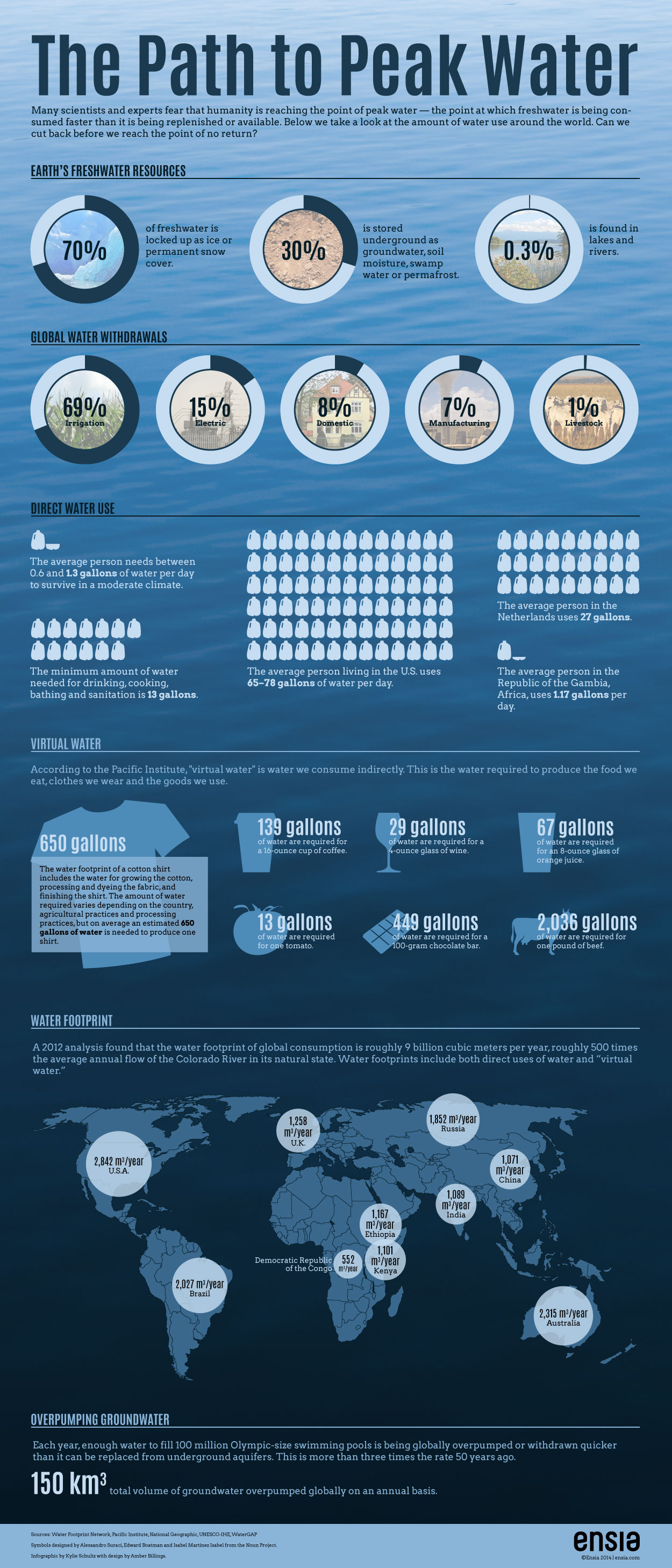

Water is the lifeblood of humanity; it turns out it is in short supply. Like any other commodity high in demand, you should keep an eye on it for investment purposes as we get closer and closer to “peak water.”

The overwhelming majority of global fresh water is locked up as ice or permanent snow cover, making it inaccessible and severely limiting our readily available supply. The average American uses 65 to 78 gallons of water per day, while the average person in the Republic of Gambia, Africa, uses just 1.17 gallons, barely above the minimum amount needed to survive.

Not only do we consume a lot of water per day, we also use huge amounts of “virtual water.” Virtual water is defined as water we consume indirectly from goods we use, food we eat, etc. Look down at your shirt, did you know that it took 650 gallons of water to make it? If you love beef, we have some bad news for you. It takes 2,036 gallons of water to produce just one pound of beef!

With all that said, there are major investment opportunities in the water supply industry. Our friends at Sprott Global have outlined three distinct areas that water investors should consider: adaption to water systems to handle changing weather patterns, improving water safety and managing storm water in urban areas. There is a need of investment in infrastructure to the tune of $45 billion in New Jersey alone over the next 20 years. Check out the article they posted that further details investment opportunities by clicking here. You should definitely keep an eye on this clear liquid gold.