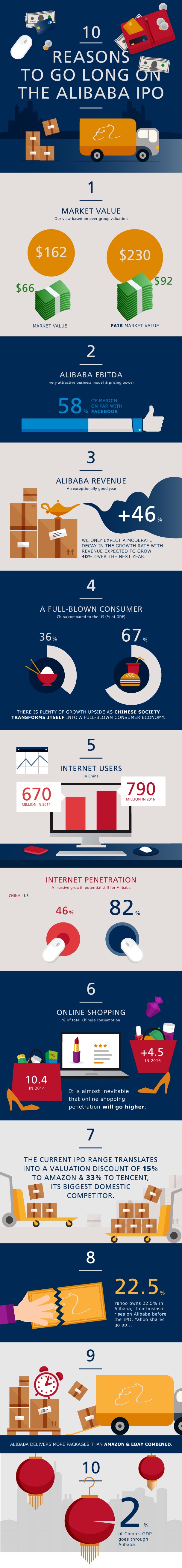

10 Reasons to Go Long Alibaba

Yesterday, Alibaba announced that underwriters exercised an option to purchase additional shares at the IPO price of $68, bumping the total amount sold from the originally planned $21.8 billion to $25 billion. This makes it the highest IPO in history.

What warrants the company’s impressive valuation? Saxo Bank has pointed out a few things of interest in this infographic that was published just before trading began. For starters, China is still a market that has not reached maturation. Only 36% of GDP is made up of private consumption, and the country is bound to gain 120 million internet users over the next couple of years. Internet penetration is only at 46%, which means there are plenty more consumers to target.

More impressive than the context stats is Alibaba itself. Revenue increased 46% in the last year and the company has an EBITDA margin of 58%. Amazingly, 2% of all of China’s GDP goes through Alibaba.

How’s trading going so far since Alibaba’s debut on the NYSE on Friday? While it finished down on Monday -$4.00 (-4.26%) to $89.89, it is still up 32% over its IPO price of $68/share.

Original graphic from: Trading Floor