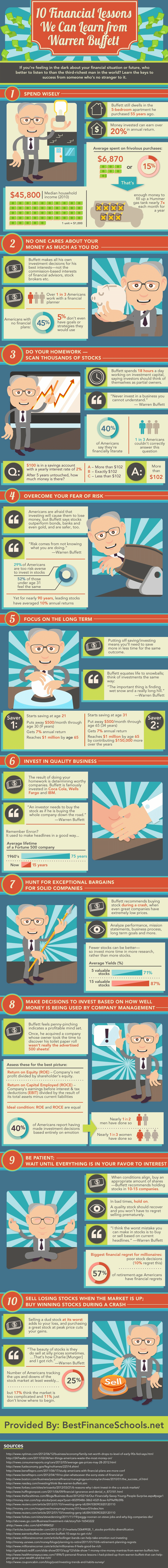

10 Financial Lessons We Can Learn from Warren Buffett

Over the years, there are few business icons that have offered up as much knowledge as Warren Buffett. From his legendary notes to Berkshire Hathaway shareholders to his famous quotes and idioms, the 84 year old has never been afraid to offer up his investment advice to the masses.

Today’s ageless infographic covers some of the most poignant lessons from the Oracle of Omaha’s career.

Warren Buffett is also well known for putting his money where his mouth is. In today’s uncharted market territory of zero rates, the real question is what Mr. Buffett is doing these days?

As Jim Rickards explains in a recent interview with Keith McCullough, Buffett is positioning himself in a way that readers of Nassim Taleb would understand: a robust portfolio that works in either a deflationary or inflationary environment that gives plenty of optionality. Rickards points to his two most recent acquisitions: Burlington Northern Santa Fe and Suncor. These are both hard assets that can excel in an inflationary environment: transportation, railway, oil, natural gas, mining rights. Meanwhile, Berkshire also has the most cash it has ever had at $55 billion, which provides a hedge for deflation and volatility, and allows him the optionality to pounce on upcoming opportunities.